What Does Resident Of Us Mean . (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. Income tax on their worldwide income. A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Although the immigration laws of the united states refer to individuals who are not u.s. Regardless of where they reside, u.s. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; One of the most complicated aspects of us tax law is oftentimes just determining whether or not a person is considered a us person and. Introduction to residency under u.s.

from www.cbs8.com

Income tax on their worldwide income. One of the most complicated aspects of us tax law is oftentimes just determining whether or not a person is considered a us person and. Although the immigration laws of the united states refer to individuals who are not u.s. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Introduction to residency under u.s. Regardless of where they reside, u.s.

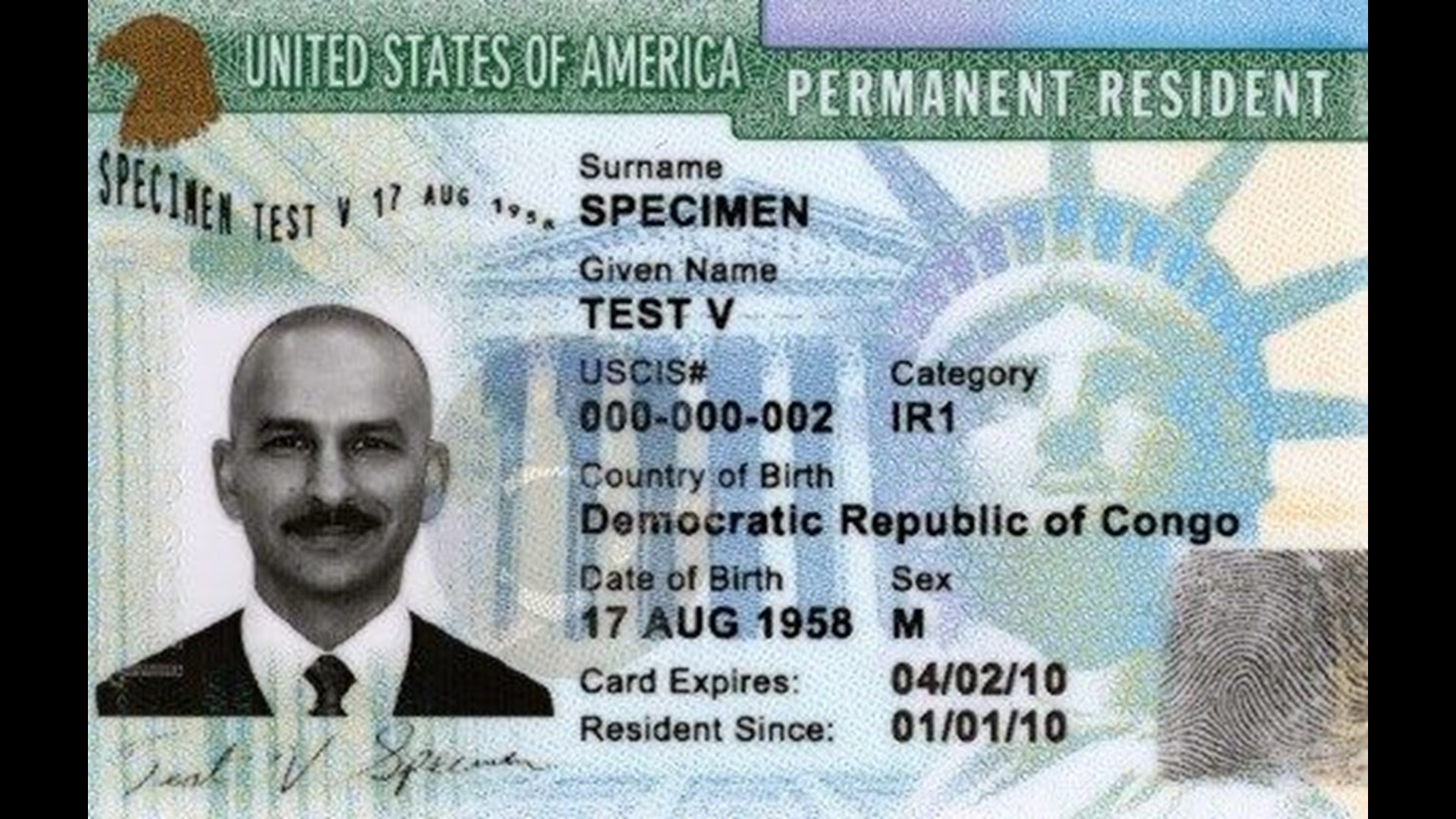

USCIS recalls thousands of Permanent Resident cards due to production

What Does Resident Of Us Mean Introduction to residency under u.s. Regardless of where they reside, u.s. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. Although the immigration laws of the united states refer to individuals who are not u.s. A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Introduction to residency under u.s. One of the most complicated aspects of us tax law is oftentimes just determining whether or not a person is considered a us person and. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. Income tax on their worldwide income. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time;

From midwestlaw.us

What does it mean to have a "Green Card?" Midwest Law What Does Resident Of Us Mean Regardless of where they reside, u.s. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. Although the immigration laws of the united states refer to individuals who are not u.s. Income tax on their worldwide income. A resident is a foreign national who can legally. What Does Resident Of Us Mean.

From www.youtube.com

Residence Meaning of residence YouTube What Does Resident Of Us Mean Regardless of where they reside, u.s. Income tax on their worldwide income. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; Introduction to residency under u.s. Although the immigration laws of the united states refer to individuals who are not u.s. A resident is a foreign national. What Does Resident Of Us Mean.

From citizenpath.com

Time as a Conditional Resident Counts for N400 CitizenPath What Does Resident Of Us Mean A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Introduction to residency under u.s. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. Income tax on their. What Does Resident Of Us Mean.

From fesimmigrationlaw.com

a US Citizen Part 1 Determining a Permanent Resident’s What Does Resident Of Us Mean A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. Although the immigration laws of the united states refer to individuals who are not u.s. Regardless. What Does Resident Of Us Mean.

From www.newsanyway.com

A Few Things You Should Know About the USA Green Card News Anyway What Does Resident Of Us Mean Although the immigration laws of the united states refer to individuals who are not u.s. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as. What Does Resident Of Us Mean.

From www.ouestny.com

What does a bit of a card mean? What Does Resident Of Us Mean Although the immigration laws of the united states refer to individuals who are not u.s. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence. What Does Resident Of Us Mean.

From flipboard.com

The Southern Maryland Chronicle (SoMDChronicle) on Flipboard What Does Resident Of Us Mean A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Although the immigration laws of the united states refer. What Does Resident Of Us Mean.

From krilaw.com

What is the Difference Between a U.S. Citizen and a Lawful Permanent What Does Resident Of Us Mean You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. Although the immigration laws of the united states refer to individuals who are not u.s. Income tax on their worldwide income. Regardless of where they reside, u.s. A resident is a foreign national who can legally. What Does Resident Of Us Mean.

From www.politsei.ee

2020 Residence permit card sample Police and Border Guard Board What Does Resident Of Us Mean Income tax on their worldwide income. Regardless of where they reside, u.s. You are a resident of the united states for tax purposes if you meet either the green card test or the substantial presence test. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. One of. What Does Resident Of Us Mean.

From www.signnow.com

Certificate of Residency 20052024 Form Fill Out and Sign Printable What Does Resident Of Us Mean Income tax on their worldwide income. A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; Although the immigration. What Does Resident Of Us Mean.

From www.scribd.com

Certificate of Residency What Does Resident Of Us Mean (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; Regardless of where they reside, u.s. Introduction to residency under u.s. You are a resident of. What Does Resident Of Us Mean.

From templatelab.com

36 Proof Of Residency Letters (from Family Member / Landlord) ᐅ TemplateLab What Does Resident Of Us Mean Although the immigration laws of the united states refer to individuals who are not u.s. Introduction to residency under u.s. Income tax on their worldwide income. Regardless of where they reside, u.s. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; You are a resident of the. What Does Resident Of Us Mean.

From www.usimmigrationconsultants.net

Permanent Resident Card Renewal I90 — US Immigration Consultants What Does Resident Of Us Mean Regardless of where they reside, u.s. Although the immigration laws of the united states refer to individuals who are not u.s. A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united. What Does Resident Of Us Mean.

From travelerlibrary.com

كيفية الحصول على جنسية جزيرة بورتوريكو الأمريكية 2022 مكتبة المسافر What Does Resident Of Us Mean (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. Although the immigration laws of the united states refer to individuals who are not u.s. Income tax on their worldwide income. A lawful permanent resident is someone who has been granted the right to live in the united. What Does Resident Of Us Mean.

From www.path2usa.com

What Is A US Green Card? Complete Process To Achieve Permanent What Does Resident Of Us Mean A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Income tax on their worldwide income. Although the immigration laws of the united states refer to individuals who are not u.s. You are a resident of the united states for tax. What Does Resident Of Us Mean.

From www.boundless.com

Alien Registration Number, Explained The U.S. Immigration A What Does Resident Of Us Mean A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. Although the immigration laws of the united states refer to individuals who are not u.s. You. What Does Resident Of Us Mean.

From www.usimmigrationconsultants.net

Permanent Resident Card Renewal I90 — US Immigration Consultants What Does Resident Of Us Mean A lawful permanent resident is someone who has been granted the right to live in the united states for an indefinite time; Although the immigration laws of the united states refer to individuals who are not u.s. (1) in general except as otherwise provided in this subsection— (a) united states resident the term “united states resident” means— (i) any. One. What Does Resident Of Us Mean.

From boilinginoil.blogspot.com

do permanent resident card numbers change Signal Site Gallery Of Photos What Does Resident Of Us Mean Regardless of where they reside, u.s. A resident is a foreign national who can legally reside and work in the united states indefinitely, either as a nonimmigrant or as a permanent resident (green card holder),. Income tax on their worldwide income. You are a resident of the united states for tax purposes if you meet either the green card test. What Does Resident Of Us Mean.